Is Polygon (MATIC) Going Down? [Price Analysis 2023]

Four Indian (Mumbai-based) software experts established the Polygon, formerly known as the MATIC Network, in 2017 with the goal of assisting Ethereum with its flexibility and scalability on blockchain networks. The dominance of MATIC, Polygon’s native token, in the crypto market underlines their continued optimism.

Currently standing at the #9th position in the CoinMarketCap rankings, which is based on its market cap, MATIC is a prominent player in the blockchain ecosystem.

MATIC’s growing partnerships with big tech giants such as Meta have led to enormous expectations for investors. However, because of the cryptocurrency market’s extreme volatility, the price of this particular token has also experienced several ups and downs, frequently leading people to wonder, “Is Polygon’ MATIC going down?”

Let us get deeper into it and come to an analytical conclusion about this subject.

Polygon (MATIC) Overview

Before moving on to the price analysis of Polygon (MATIC), we should know about the basics of it. So, let’s have an overview of the token and make our way to the in-depth analysis.

| Price | $1.15 |

| 24-hr volume | $287,285,246 |

| Circulating Supply | 8,734,317,475 MATIC |

| Market Cap | $10,022,246,219 |

| Fully Diluted Market cap | $11,473,016,486 |

How does Polygon (MATIC) work?

Polygon (MATIC) is a blockchain network built as a layer 2 scaling solution for Ethereum in Web 3.0. The network has developed eight technologies, of which Polygon PoS (proof-of-stake) is one.

It is a solution provided by Polygon (MATIC) that helps in achieving extraordinary transaction speed while saving on fees by utilizing side chains during transactions.

The side chains on the Polygon are developed to support the DeFi (decentralized finance) agreement on Ethereum.

Ethereum was facing a blockchain trilemma, which means that the more the data is decentralized and secure, the more difficult it is to be processed fast and cheaply.

This limited the volume and size of transactions on their blockchain network.

Polygon (MATIC) came up with a layer-2 scaling solution for Ethereum to scale fast, cheaply, and efficiently.

Polygon POS (proof-of-stake) transaction speeds are up to 7,000 tx/s, which is much faster than Ethereum, which is at 15 tx/s.

MATIC is a token used as cryptocurrency to govern Polygon networks, with its major purpose being to secure its proof-of-stake (PoS) system. It is used to pay network fees as “gas fees” for the power consumed to transfer data into the network.

By paying MATIC tokens, software developers and ecosystem contributors can build dApps on the platform.

Price analysis of Polygon (MATIC)

To get an idea about whether the MATIC is going up or down, we must analyze the price trend of Polygon (MATIC), including how it started and how it is going now.

The MATIC token stimulated its price chart on April 28, 2019, with a price of $0.004521 per token. So far, its all-time high has been $2.9232, and its all-time low has been $0.0031.

If we look at recent stats (past 1 month), MATIC was at its peak on February 18, with price $1.5524. The past one month seems pretty unstable for MATIC. In the beginning of the month, it started rising but in the end (till now), it is in the downtrend.

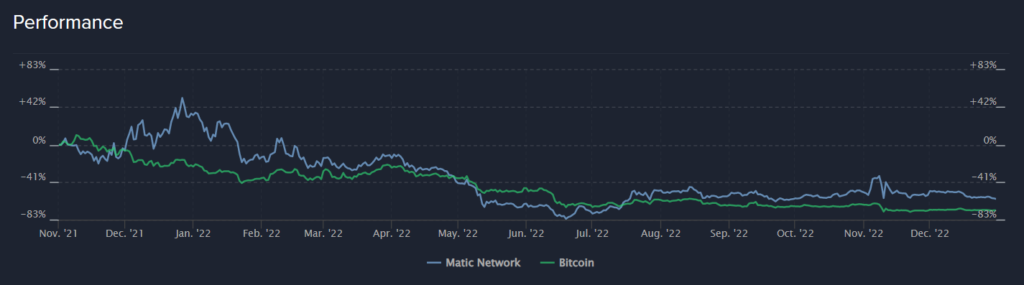

Nevertheless, Polygon (MATIC) was one of the cryptocurrencies that did particularly well during the bear market as well. This signifies its potential in the near future.

MATIC was less affected by the bear market due to its early stage and lack of a hyped trend, and investors base their decisions on visions provided by the company for the betterment of the Web 3.0 ecosystem.

In June 2022, Polygon (MATIC) was trading at $0.3466, its lowest point in the bear market. Since then, there have been ups and downs for the cryptocurrency.

The year 2023 is expected to be a good year for MATIC, as it has started climbing and the developers are out there to launch their new technology to assist the development of the blockchain ecosystem.

Is Polygon (MATIC) going down or up?

This question, however, is time-sensitive. This can be answered by going through the following two approaches:

Analysis based on historical data and events

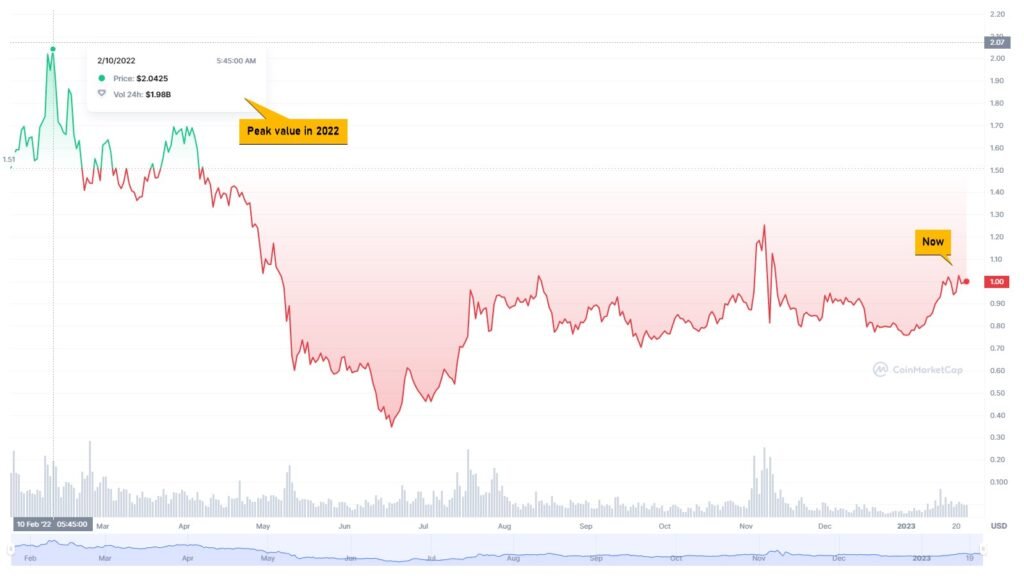

Comparing the price of MATIC a year ago with the current price, we can conclude that the cryptocurrency is still in decline. Notably, in the last year, its peak value was $2.0425 on February 10, but it is now revolving around $1.

Hence, from this perspective, we can say MATIC is down. However, we will also evaluate the subject from another angle, which will be discussed in the following sections.

Before we get there, let’s take a look at some of the events that may have prevented Polygon (MATIC) from resuming its upward trend.

Bankruptcies

Being a highly volatile space, it is very easy for people to manipulate and play with the crypto market. There have been numerous scams and bankruptcies in the market, which have contributed to the overall decline of cryptocurrencies.

For instance, Celsius Network, a major US cryptocurrency lending company, went bankrupt in June 2022 as a result of an industry-wide liquidity crunch that froze withdrawals and transfers and led to bankruptcy.

Their collapse in the market also caused a ripple effect on other companies to freeze assets, which led to a negative downfall in the overall crypto market.

Despite the fact that MATIC has experienced a drop during the bear market, for this year, experts and traders have predicted an uptrend.

Analysis based on recent events and market trends

Looking at recent statistics, particularly those from early 2023, we can conclude that the Polygon (MATIC) is not declining dramatically, but rather continuing to grow slowly and steadily.

Despite a slight uptrend, Polygon (MATIC) could have reached even higher levels if the crypto market had not been disrupted by the bankruptcy of a major crypto exchange, FTX.

FTX collapse – A recent tragedy in the crypto market

FTX was the second-biggest crypto exchange by volume after Binance. In November 2022, an article was published as Alameda’s balance sheet was leaked, which led to the downfall of FTX as investors were not happy with the leaked data. CZ Binance declared it would offload roughly 23 million FTT tokens. The announcement set off mass withdrawals by the people.

After that event, FTX’s finances were in crisis, which led to FTX’s collapse. FTX, being one of the biggest competitors in the crypto market, crashed within days, which created a negative impression on the crypto market.

Not only did investors back out of the FTX token, but they also pulled out from other cryptos making a repulsion effect that led the whole crypto market to the downfall.

Despite crypto falling negatively, we can see that Polygon (MATIC) was affected, but it was one of the cryptos that stood out from crashing rapidly. The majority of investments in Polygon (MATIC) by the investors are entirely based on the company’s purpose of creating a better ecosystem for Web 3.0.

Should you invest in Polygon (MATIC) in 2023?

Now that you know the status of the price trend of Polygon (MATIC), you may be wondering about investing in the digital asset if you are not already an investor.

It can be a good decision to invest in it and there are many promising reasons for this.

Polygon (MATIC) has been performing well with its technology to help scale the blockchain network on Ethereum. Ethereum is the largest blockchain network in the world, and Polygon (MATIC) is one of the parts of that ecosystem, making it an important and long-running project in the crypto space.

Polygon has performed a lot better than other cryptocurrencies during the bear market.

From the perspective of the company’s aim and direction polygon (MATIC), it is quite promising as they have solved one of the major problems in the crypto space.

Up until now, the Polygon network has been able to build a good impression in the industry, and they are still out there trying to solve major problems with their new technology. Polygon (MATIC) has become an important part of the overall Web 3.0 ecosystem.

Notably, MATIC is still in the process of becoming the next big cryptocurrency. Early investment is preferable because the developers are optimistic about their goals and still have a lot to offer the market.

Conclusion

Summing up the entire data and event analysis of this article, it can be concluded that the Polygon (MATIC) is currently not in an extreme position. It is neither falling unexpectedly nor rising surprisingly. Notably, it is still quite far from its all-time high.

Despite several disasters in the crypto market, Polygon (MATIC) has seen a much stable price trend compared to many notable cryptos. This indicates MATIC’s potential to grow even higher, notably in the long-term.

Disclaimer: This article solely reflects the personal opinion of the author and should not be taken as investment advice. Before investing in any asset, people should conduct thorough research on their own because this market is very unpredictable. Also, they must be aware of the risks and consequences of bad investments. Read our complete disclaimer.