Crypto Cost Basis Calculator

Results

| Total cost basis: | $0 |

| Average cost basis: | $0/coin |

| Total coins: | 0 |

| Total fees paid: | $0 |

⚡Powered by Moneybinds

Try our Crypto Market Cap calculator.

What is crypto average cost (crypto cost basis)?

The term “crypto average cost” simply refers to how much money you have invested per coin to obtain a specific number of cryptocurrencies. For example, if you spent $10,000 to acquire 100 altcoins, your average crypto cost is $100 per altcoin.

The terms “Crypto cost basis calculator” and “Crypto average price calculator” are also used to search for such a tool that helps you find your average cost to acquire a specific amount of cryptocurrencies. It is worth noting that here “acquire” means either purchasing cryptos or exchanging one crypto for the other.

In the following sections, we will go over these topics in depth with examples. You will also learn how to calculate your total cost or average cost (cost per coin) using our fantastic free crypto cost basis calculator tool.

How to calculate the average cost of crypto?

Calculating the average crypto cost does not require you to use complex maths. It is very simple. All you have to do is divide your total cost, including the fee, by the total number of coins you acquired with this investment.

i.e., Average crypto price = (Total cost)/(Number of coins acquired)

Or, this formula can also be written more precisely as, Average crypto price = ((Price*No. of coins) + fee amount)/No. of coins. This is the formula for only a single purchase/exchange. But, if you have gone through multiple transactions, you will have to solve multiple equations to calculate your average crypto price.

Let’s take an example;

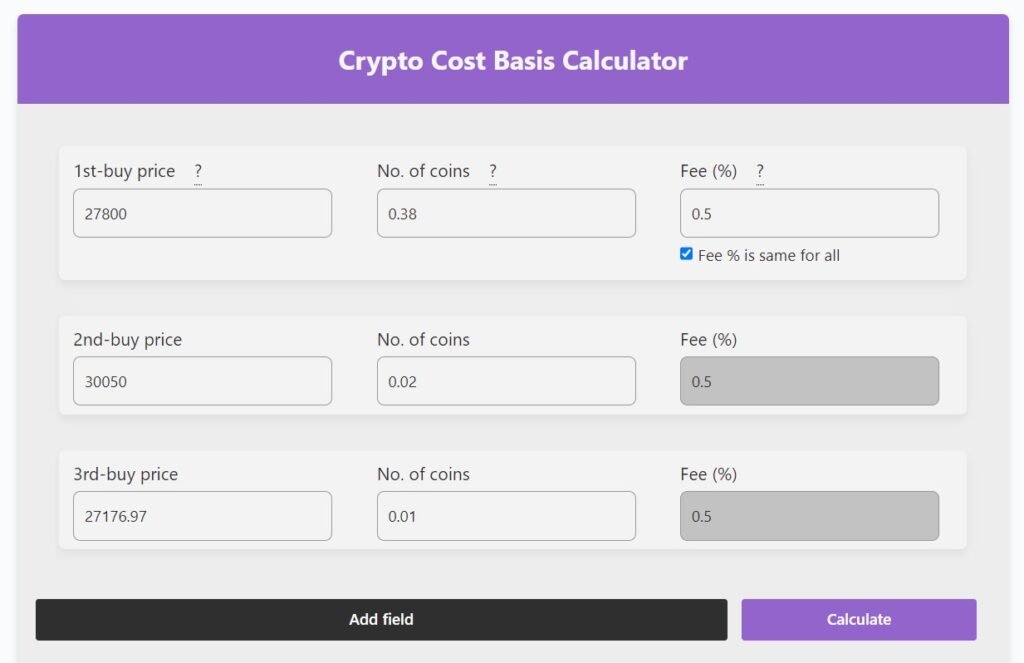

Suppose, in a period of time, you purchased Bitcoins (BTC) three times as below:

1st-buy:

- Price – $27,800

- Quantity (no. of coins) – 0.38 BTC

- Fee – 0.5%

2nd-buy:

- Price – $30,050

- Quantity (no. of coins) – 0.02 BTC

- Fee – 0.5%

3rd-buy:

- Price – $27,177

- Quantity (no. of coins) – 0.01 BTC

- Fee – 0.5%

To calculate how much on average you spent to acquire 1 BTC, i.e., calculate Average Bitcoin cost, you will need to perform the following calculations:

Average Bitcoin cost = (27800*0.38*1.005+30050*0.02*1.005+27177*0.01*1.005)/(0.38+0.02+0.01) = $28034.03

Therefore, your average cost of acquiring 1 BTC is $28,034.03.

If you have enough time and like to do calculations, you can go with this approach; if not, we have a very easy-to-use and free tool that will get you this calculation done within seconds.

Let’s put the same data in the Crypto Average Cost Calculator tool above and see the results.

We will get the results as follows:

| Total cost basis: | $11,493.95 |

| Average cost basis: | $28,034.03/coin |

| Total coins: | 0.4100 |

| Total fees paid: | $57.18 |

Note: You can use the “Add field” button to add input fields for 4th-buy, 5th-buy, and so on, according to your need. Also, check the checkbox below the first fee box if the fee percentage charged by your exchange is constant for all purchases. It will automatically fill the other fee boxes and save you time.

Why do we calculate crypto average cost?

If you’ve arrived at this calculator page, you’re probably aware of why we calculate average crypto cost basis. However, if this is not the case, the quick answer is the average crypto cost plays a vital role during tax filing.

As a crypto trader, you will owe tax when you realize a taxable event, such as selling or exchanging cryptocurrencies for other cryptocurrencies or fiat currency (like USD or EUR). Any gains or losses on the sale or exchange of cryptocurrency must be reported on your tax return.

Your capital gain/loss is calculated by subtracting the total cost basis from the selling price. i.e., Capital gain/loss = Selling price – Total Cost Basis (if this is negative, you have a capital loss, which is usually not taxable).

Note: Calculating taxes on crypto capital gains and losses isn’t that straightforward. There are multiple methods of doing this. You may read TokenTax’s guide on calculating crypto taxes.

In another approach, you can also find the crypto average price to determine the selling price of the same virtual currency to make a profit. For example, if your average cost basis is $10,000 per coin, then you must sell it at a rate above this mark to make a profit.

Conclusion

Our free crypto cost basis calculator also called crypto average cost calculator will help you determine how much per coin you have invested to acquire a specific amount of cryptocurrencies. That is, your current crypto average cost is the value of your crypto portfolio (for a particular crypto) per coin.

You might have been confused if you only read this guide. We suggest you try out the awesome calculator and play with different values. You will surely learn the concept.

Also, check out our other useful financial tools to make your financial calculations easier.

Disclaimer: This tool helps you to know only the estimates and its results may not be sufficient in individual cases. Users are advised to take expert consultancy before taking any financial step.