The Surprising Rise of Bitcoin: How it’s Defying the FTX Collapse

FTX, a leading cryptocurrency exchange that was valued at $32 billion a year ago, became bankrupt in early November 2022. FTX’s demise began after CoinDesk published a report revealing the balance sheet of its sister company Alameda Research.

Following the FTX collapse, a large number of investors began withdrawing funds from the company, causing the price of FTT, the company’s native token, to fall. This digital disaster had far-reaching consequences for the entire cryptocurrency market.

The collapse of the giant crypto exchange harmed investors’ trust, which was eventually reflected in the falling price of many digital coins, including the biggest, Bitcoin.

Although analysts predicted that the prices of cryptocurrencies would not rise significantly in the near future as a result of the FTX disaster, Bitcoin began climbing again a few months later, recouping the loss.

In this article, we will delve deeper into the possible reasons why bitcoin is rising in the charts despite the FTX collapse.

Impact of FTX collapse on Bitcoin

Before we talk about how Bitcoin recouped the FTX disaster, let’s take a look at the major consequences of the collapse, particularly on Bitcoin.

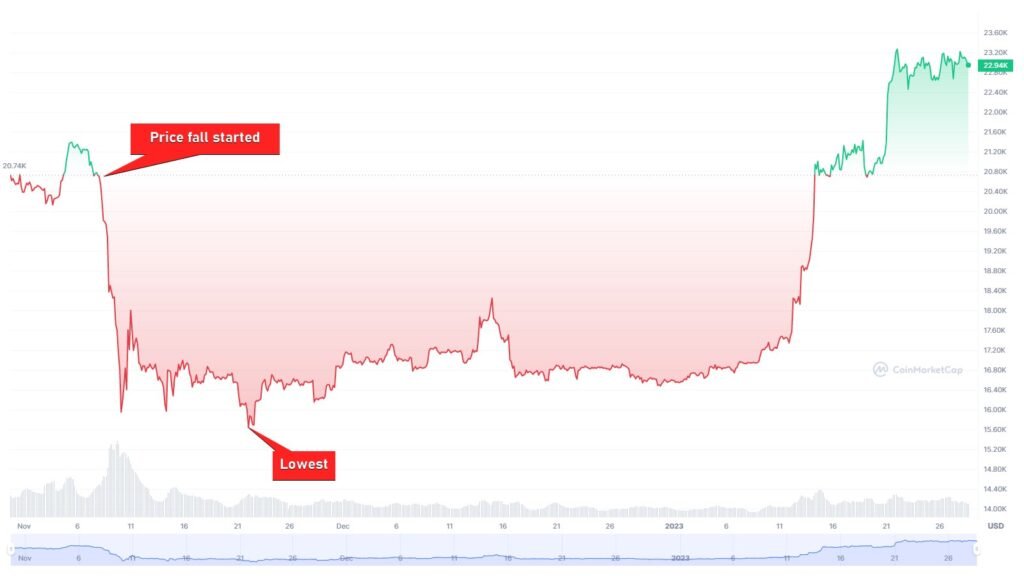

Surprisingly, BTC reached its price of $15,599.05 on November 21, 2022, which was the lowest price in the last two years, as of writing this article.

There is no report confirming that the FTX collapse caused the massive drop in Bitcoin; however, based on the information available, we can conclude that it was a result of the collapse.

The Bitcoin drop started on November 8, which was the date when FTX was going through its worst phase. On November 7, Bitcoin’s price was $21,053.25, and it reached $15,682.69 on November 9, going through a -25.51% change in just two days. The price kept hovering around the same level until mid-January.

Bitcoin started rallying on January 14.

BTC was worth $18,753.16 on January 13 and crossed $21,000 the next day, a +12.38 percent increase. BTC’s price rose significantly again between January 20 and 21.

In this manner, BTC rose above its $21,000 mark, which it had reached prior to the FTX crash.

Reason behind sudden rise of Bitcoin after FTX fallout

FTX’s impact was very broad, affecting the entire cryptocurrency market. However, as described earlier, Bitcoin rallied above $21,000 again after nearly two months since the firm’s collapse.

Analysts and experts say that there is a high probability for the Federal Reserve to slow down the increase in the interest rates. This could be the major reason why Bitcoin is rising defying FTX collapse.

Some market participants expect that the central bank may moderate the increase in borrowing interest rates later this year. As per CNBC’s report, some economists predict for a Fed rate cut to happen this year.

Large investors, often called “whales” may also be the reason for BTC’s rapid recovery from the FTX collapse.

According to Kaiko, a cryptocurrency market data firm, the average trade size reflects the vital role of large investors (whales) in contributing to this crypto boom, particularly Bitcoin.

As informed by the firm, the trade size on Binance, world’s largest crypto exchange, has boosted from approximately $700 to $1.1K.

Conclusion

Bitcoin and other cryptocurrencies are recovering from the FTX debacle. Investors’ belief that the Federal Reserve will slow the increase in interest rates and mature investors’ thinking of buying the digital asset are likely factors contributing to this digital coin surge.

Having said that, the consequences of FTX’s fallout cannot be underestimated. The implications are still scorching, adding fuel to the market’s volatility.

Disclaimer: This article is based on our personal opinion and research. It should not be construed as investment advice. Individuals are encouraged to make sophisticated decisions after conducting extensive research and seeking advice from industry experts before investing in any asset. Read our full disclaimer.